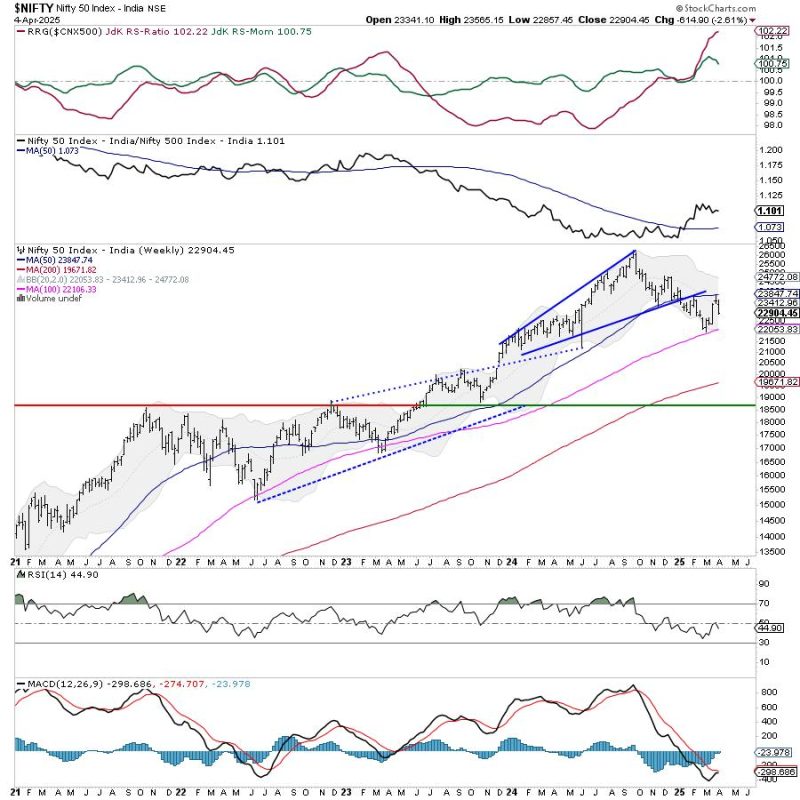

The previous week was short; the Indian markets traded for four days owing to one trading holiday on account of Ramadan Id. However, while staying largely bearish, the markets weathered the storm inflicted by the US announcing reciprocal tariffs on almost everyone and kicking off a serious trade war. The Indian markets stayed extremely resilient but ended the week on a negative note. The Index moved in the range of 707.70 points over the past four sessions. The volatility also rose; the India VIX surged 8.16% on a weekly basis to 13.76. The Indian benchmark Index closed with a net weekly loss of 614.90 points (-2.61%).

The equity markets across the world are likely to stay under pressure and in a bit of turmoil. However, the Indian markets are likely to remain relatively resilient. We live in an interconnected world; it is not surprising if we see the markets staying under pressure along with the other equity markets. However, what is expected to stand out will be the Indian market’s expected relative outperformance. This was evident over the previous week as while the Nifty and Nifty 500 lost 2.61% and 2.50%, the US key indices SPX, Nasdaq, and the Dow lost 9.08%, 10.02%, and 7.86%, respectively. While India’s VIX spiked just over 8%, the CBOE VIX has spiked 109.14% on a weekly basis. While the Indian markets may also show jitters and stay under pressure, this relative outperformance is likely to persist.

The coming week is again short, with Thursday being a trading holiday for Shri Mahavir Jayanti. The markets are expected to start lower on Monday following global weakness. Over the coming week, we can expect the levels of 23050 and 23300 to act as potential resistance points. Importantly, the supports are expected to come in at 22600 and 22450.

The weekly RSI is at 44.93; it stays neutral and does not show any divergence against the price. The weekly MACD is bearish; however, the sharply narrowing Histogram hints at a likely positive crossover in the future. A strong black-bodied candle showed the sustained downward pressure on the markets.

The pattern analysis of the weekly chart shows that after rebounding off the 100-week MA, the Nifty staged a strong rally that halted at the 50-week MA. This MA is placed at 23849; this was the support that the Index had violated on its way down, and now acts as a resistance. The previous week also saw the Nifty slipping below the 20-week MA positioned at 23412. While the Index stays in a secondary trend, it remains in a large but well-defined trading range that is created between 23400 on the upper side and 22100 on the lower side.

Despite being short, the coming week is expected to see a wider trading range and some more volatility staying ingrained in it. It is strongly recommended that while the valuations look tempting enough to initiate buying, all fresh buying should be done in a staggered manner. One must not go out and buy everything all at once, but one should do it in a staggered way while allowing the prices to stabilize and indicate a potential reversal point. Leveraged positions must be kept at modest levels, and fresh purchases must be kept limited to the places where there is emerging relative strength. A cautious approach is advised for the coming week.

Sector Analysis for the coming week

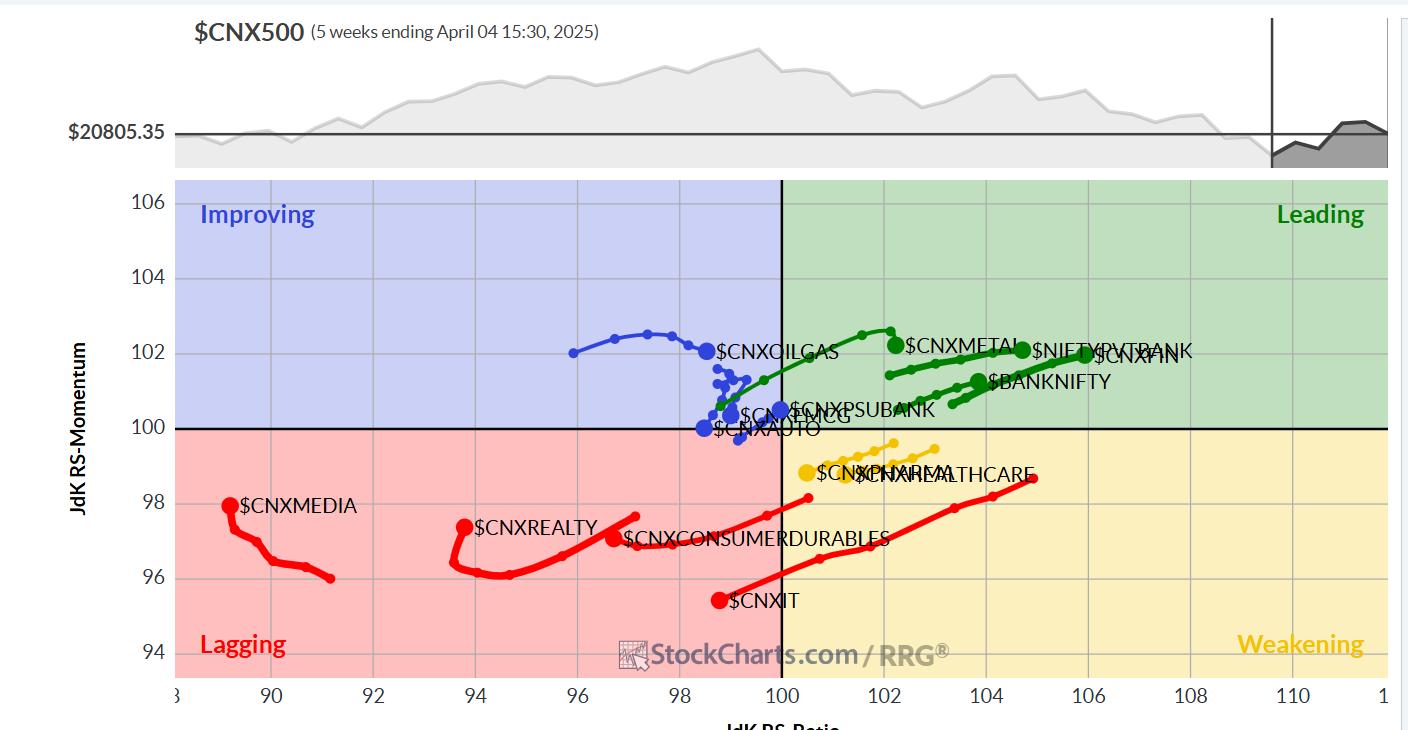

In our look at Relative Rotation Graphs®, we compared various sectors against CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all the stocks listed.

Relative Rotation Graphs (RRG) show the Nifty Bank and Financial Services indices are rolling strongly inside the leading quadrant. Besides these two indices, the Nifty Commodities, Metal, Infrastructure, and Services Sector Indices are also inside the leading quadrant.

The Nifty Pharma Index is the only one inside the weakening quadrant.

The Nifty IT Index has rolled inside the lagging quadrant and is languishing inside that quadrant along with the Nifty Midcap 100 index. The Nifty Realty and the Media Index are also in the lagging quadrant; however, they are improving relative momentum against the broader markets.

The Nifty PSE and Energy Indices are inside the improving quadrant along with the PSU Bank index, which is seen as strongly improving its relative momentum. The FMCG, Auto, and Consumption Indexes are also inside the improving quadrant but are seen rolling towards the lagging quadrant again while giving up on their relative momentum against the broader markets.

Important Note: RRG charts show the relative strength and momentum of a group of stocks. In the above Chart, they show relative performance against NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

charts show the relative strength and momentum of a group of stocks. In the above Chart, they show relative performance against NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst